The Financial Advisor's Guide

Case Study: Transformation Through Niche Specialization

Choosing a niche market is one of the smartest strategic decisions an advisory firm can make. But here is the critical insight most advisors miss: selecting a target market is only step one. The real transformation—and the competitive advantage—happens when you completely redesign your service model, your workflows, and your technology stack to meet the specific expectations of that niche.

This guide shares a real-world case study of an advisory firm that doubled down on serving dentists who own their own practices. What we discovered transformed not just their business model, but their entire approach to delivering value. The lessons here apply to any advisor serious about building a differentiated, scalable practice around a target market.

About reframeRIA

At reframeRIA, we help emerging RIA practices elevate their operations through strategic planning, technology optimization, and process improvement. We specialize in working with firms who are ready to reframe their services around a specific target market and build the operational foundation for sustainable growth.

Ready to make the right decision? Let's talk about your specific needs and help you avoid costly mistakes.

Bottom Line Up Front

The Strategic Imperative: Choosing a niche is not enough. The firms that truly win are those who go further—they reframe their services, redesign their workflows, and invest in the right technology, all with their target market's wants, needs, and expectations at the center.

The "So What"

Here is the bottom line: choosing a niche is a strategic decision that opens the door to differentiation. But walking through that door requires deliberate transformation across your entire practice. The firms that simply pick a target market and keep operating the same way will struggle to differentiate from generalist competitors. The firms that redesign their entire approach around their niche will create sustainable competitive advantage, command premium fees, and build referral engines that fuel organic growth.

This guide breaks down exactly how one firm made that transformation—with specific frameworks, exercises, and implementation strategies you can apply to your own practice.

Key Takeaways

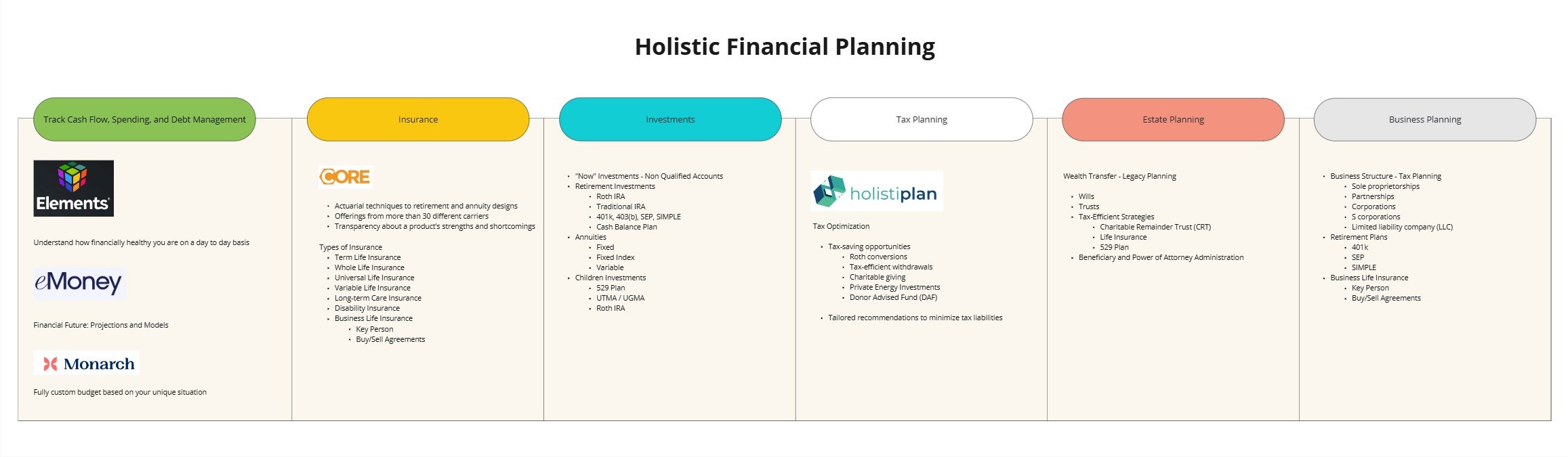

From Generic to Specialized: This firm moved from a generalist model focused primarily on investment and insurance products to a holistic advisory practice specifically designed for dental practice owners. The shift required rethinking everything from service offerings to client communication cadence.

Three Pillars of Transformation: Success required simultaneous evolution across three dimensions:

(1) reframing the service model to address business owner needs

(2) redesigning operational workflows for consistency and professionalism

(3) rebuilding the technology stack to support elevated service delivery

Client Expectations Drive Everything: By systematically mapping what their target market wanted, needed, and expected, the firm gained clarity on where to invest time and resources. This exercise revealed that the traditional "meet twice a year and review your portfolio" model was completely misaligned with client expectations.

Technology Enables the Vision: Strategic technology decisions—adding Elements for holistic planning visualization, implementing Holistiplan for tax analysis, automating workflows for communication and documentation—turned the firm's service vision into operational reality.

Watch the full case study video below, then dive into the detailed breakdown of how this transformation unfolded.

🎥 Watch on YouTube: Redefining Your Firm Around Your Niche Market | Real Advisory Firm Transformation

Understanding the Starting Point

The Generalist Trap

The firm in this case study was built on a traditional generalist model. As the practice transitioned from father to son, the younger advisor had developed strong connections with dentists who owned their own practices—an excellent foundation for building a specialized wealth management practice.

However, despite having identified this target market, the firm was not yet truly serving them as specialists. They faced three critical challenges that prevented differentiation:

Challenge 1: Generic Service Model

The firm's service offerings were primarily centered on investment management and insurance products—the traditional building blocks of financial advisory services. While these are important, they did not address the specific, complex needs of dental practice owners:

Tax planning beyond basic tax preparation

Business planning for practice growth, partnerships, and financing

Wealth concentration strategies addressing the fact that most net worth was tied up in the practice itself

Liability protection appropriate for high-income professionals

Retirement planning accounting for fluctuating income

The firm was offering solid financial advice, but it was not designed for this specific clientele. They were competing on the same terms as every other advisor.

Challenge 2: Manual and Inconsistent Workflows

Client onboarding lacked standardization. The experience varied and follow-up communications happened sporadically rather than proactively. Tax planning conversations took place once per year rather than as an ongoing, strategic element of the relationship.

This inconsistency created several problems:

Clients did not know what to expect or when to expect it

The firm could not efficiently scale because every client experience was slightly different

Team members spent excessive time on administrative coordination rather than high-value advisory work

Opportunities to demonstrate value early in the relationship were missed

Challenge 3: Disconnected Technology Stack

The technology infrastructure was working against the firm rather than for it. The CRM system operated independently without workflow automation to ensure consistent processes. Different planning software packages held different pieces of client information. Portfolio management happened in one system, financial planning in another, and client communication in yet another.

The result was friction everywhere:

Team members entered the same data multiple times across different systems

Client information existed in silos, making holistic advice more difficult

Generating comprehensive reports required manual effort pulling from multiple sources

Onboarding new clients meant setting them up in three or four different platforms separately

Why This Matters

Despite having a clear niche market and good client relationships, the firm was not delivering the elevated experience that successful business owners expected and deserved. They were working harder, not smarter. And most importantly, they were not differentiating themselves in the marketplace.

The opportunity was clear: reframe the entire practice around the specific needs of dental practice owners. But executing that transformation required systematic work across three core areas: service model, operational workflows, and technology infrastructure.

Action Items for Your Firm

Before moving forward with any niche market strategy, honestly assess your current state:

Audit your service offerings. Are they truly designed for your target market, or are they generic services that could apply to anyone? What specific needs of your niche are you not addressing?

Map your client experience. Walk through your onboarding process, ongoing service delivery, and communication cadence. Is the experience consistent? Professional? Differentiated? Or is it reactive and dependent on who happens to be working with the client?

Evaluate your technology stack. Do your systems integrate seamlessly? Can information flow between platforms without manual data entry? Or are you working around your technology rather than being empowered by it?

Identify the gap. What is the difference between the experience you currently deliver and the experience your target market expects? That gap represents your transformation opportunity.

Understanding What Your Target Market Truly Values

The Foundation of Differentiation

Before you can design services that truly differentiate your firm, you need deep clarity on what your target market wants, needs, and expects. This is not about assumptions or generalizations—it requires systematic discovery and honest dialogue with the clients you serve.

We use a structured framework with three distinct categories: wants (aspirational goals), needs (technical requirements), and expectations (service delivery standards). This framework creates clarity not just for advisors but for the entire team about what matters most to the clients you serve.

The Framework: Want, Need, Expect

What They WANT (Aspirational Goals)

These are the emotional, lifestyle-driven outcomes your clients are pursuing. For dental practice owners, common wants include:

"I want to retire at 55 and sell my practice for top dollar"

"I want to know my family is financially protected if something happens to me"

"I want someone who understands my business, not just my portfolio"

"I want to enjoy life now while building long-term wealth"

Notice that these are not technical requests—they are personal, emotional, and tied to life goals. Yet they should inform everything about how you structure your services and communicate value.

What They NEED (Technical Requirements)

These are the specific financial strategies and solutions required to achieve their wants. For dental practice owners, needs typically include:

Tax-efficient strategies that account for high income plus practice profits

Business succession planning including practice valuation, associate buy-ins, and eventual sale

Estate planning that addresses practice ownership, buy-sell agreements, and asset protection

Liability protection strategies appropriate for high-income professionals

Retirement planning that accounts for practice sale proceeds and transition timing

Cash flow management for fluctuating income and major equipment purchases

Insurance planning covering disability, life, liability, and key person coverage

Investment management that complements their already-concentrated wealth in the practice

These technical needs should drive your service design, your technology selection, and your team's skill development priorities.

What They EXPECT (Service Delivery Standards)

These are the non-negotiable standards for how you deliver your services. Successful business owners typically expect:

Responsiveness: Quick replies to questions and proactive communication about important matters

Proactivity: You bring ideas to them rather than waiting for them to ask

Integration: Holistic advice that considers all aspects of their financial picture, not siloed conversations

Efficiency: Technology and processes that make their life easier, not harder

Expertise: Demonstrated understanding of their specific challenges as dental practice owners

One-stop-shop: Comprehensive financial advice rather than being referred out for every specialized need

Understanding these expectations is critical because unmet expectations—even when technical advice is sound—lead to client dissatisfaction and attrition.

The Discovery Exercise

When we conducted this exercise with the firm, we used a collaborative workshop format that engaged the entire team. Here is how it worked:

Step 1: Individual Brainstorming (Silent work to encourage all voices) Each team member independently wrote down what they believed clients in their target market wanted, needed, and expected. This silent brainstorming phase prevents groupthink and ensures quieter team members contribute.

Step 2: Group Sharing and Clustering The team shared their inputs and organized them into themes. Common patterns emerged quickly, as did surprising insights about gaps in the current service model.

Step 3: Client Validation The firm then validated their assumptions through structured conversations with existing clients and prospects. They asked open-ended questions like:

"What are your biggest financial concerns right now?"

"What would an ideal relationship with a financial advisor look like for you?"

"What frustrates you about how financial services are typically delivered?"

Step 4: Synthesis and Prioritization Finally, the team synthesized all inputs into a clear, prioritized understanding of what mattered most to dental practice owners.

What This Revealed

The exercise produced several transformational insights:

Service Model Misalignment: The firm realized their investment-centric model was misaligned with what clients actually valued most—tax planning, business strategy, and holistic financial coordination.

Communication Gaps: Clients expected proactive, year-round communication but were receiving reactive, twice-yearly portfolio reviews.

Differentiation Opportunity: By expanding into tax planning and business advisory services, the firm could differentiate from other advisors who referred these services elsewhere.

Technology Implications: Delivering the one-stop-shop experience clients expected required technology that could integrate tax analysis, financial planning, and business planning into a cohesive presentation.

Team Development Needs: The team needed to build new capabilities in tax planning and business advisory services to deliver on the reimagined service model.

The Power of Clarity

Once you have clarity on what your target market truly values, you can make confident decisions about:

What services to offer (and what to simplify or eliminate)

How to price your services based on delivered value

What technology to invest in

What skills your team needs to develop

How to communicate your differentiation in the marketplace

Where to focus your time and energy for maximum client impact

This clarity transforms strategy from guesswork into deliberate design. You stop assuming you know what clients want and start building your practice around what they have told you they value.

Action Items for Your Firm

Conduct the Want-Need-Expect exercise with your team for your specific target market. Use the framework above and give each team member time to contribute.

Validate with clients. Schedule structured conversations with 5-10 clients in your target market to test your assumptions. Ask open-ended questions and listen carefully to their answers.

Identify misalignments. Where are the biggest gaps between what your target market values and what your current service model delivers?

Prioritize changes. Based on what you have learned, what 2-3 changes would have the biggest impact on meeting client expectations and differentiating your firm?

Document your findings. Create a clear, written summary of what your target market wants, needs, and expects. This becomes the north star for all strategic decisions going forward.

The Three Strategic Shifts That Created Differentiation

From Generic to Specialized

With clarity on what dental practice owners valued and a redesigned onboarding process to deliver immediate impact, the firm was positioned to make three strategic shifts that fundamentally transformed their practice and created sustainable competitive advantage.

Strategic Shift 1: Simplify and Standardize Investment Management

The Counterintuitive Move

While many advisors believe they need to offer extensive investment customization to justify their fees, this firm made the opposite choice: they simplified their investment approach dramatically.

They recognized that dental practice owners did not need 47 different portfolio options or highly customized investment strategies. What they needed was a disciplined, evidence-based investment approach they could trust while focusing mental energy on running their practices and building their businesses.

The Implementation

The firm developed a streamlined investment philosophy built on:

Asset allocation models based on time horizon and risk tolerance

Low-cost, diversified index funds as the core building blocks

Rebalancing discipline executed consistently based on preset thresholds

This standardization delivered several benefits:

Operational efficiency: Portfolio management became scalable across many clients

Consistency: Every client received the same high-quality investment approach

Focus: Team capacity shifted from investment tinkering to higher-value planning activities

Clarity: Clients understood the strategy and felt confident in its implementation

The Communication Strategy

The firm communicated this approach as a strength, not a limitation: "We believe investment success comes from discipline, not complexity. This frees us to focus on the areas where customization really matters—your tax strategy, business planning, and comprehensive financial goals."

Strategic Shift 2: Expand and Elevate Financial Planning Services

The Core Transformation

With investment management simplified, the firm redirected capacity toward expanding their financial planning services. This is where true differentiation happened.

Tax Planning: From Annual Event to Year-Round Strategy

Rather than discussing taxes once per year during tax preparation season, tax planning became woven into the entire relationship:

Proactive Roth conversion analysis whenever market conditions or income changes created opportunities

Retirement plan optimization helping maximize tax-advantaged savings while managing cash flow

Multi-year tax projection modeling showing the impact of major decisions before they are made

The firm implemented Holistiplan software to systematically analyze client tax returns and identify opportunities. This technology investment enabled the expanded service while maintaining efficiency.

Business Planning: From Afterthought to Core Service

Business planning became a central pillar of the firm's value proposition, specifically designed for dental practice owners:

Practice valuation analysis helping owners understand their practice's current value and value drivers

Associate partnership structuring advising on associate buy-ins, equity splits, and transition planning

Overhead analysis benchmarking practice efficiency against industry standards

Compensation planning ensuring owner compensation was optimized for both cash flow and tax efficiency

This business planning work required developing expertise and building relationships with other professionals (CPAs, attorneys) who served the dental community.

Estate Planning: Integrated, Not Referred Out

Rather than simply referring clients to estate planning attorneys, the firm took ownership of estate planning coordination:

Estate planning strategy development before clients ever met with attorneys

Document review and gap analysis after estate documents were created

Beneficiary designation audits ensuring all accounts aligned with estate plan intent

Trust funding coordination making sure trusts were properly funded with appropriate assets

Regular estate plan reviews as family circumstances, tax laws, or asset values changed

The firm did not practice law, but they took responsibility for ensuring clients had comprehensive, well-executed estate plans that integrated with their overall financial strategy.

Strategic Shift 3: Rebuild the Technology Stack to Enable Excellence

The Strategic Technology Decisions

Technology was not chosen for its features but for its ability to support the firm's elevated service model. Three key additions transformed service delivery:

Elements: Holistic Planning Visualization

The firm adopted Elements financial planning software, which uses a unique "vital signs" approach to financial health. Rather than overwhelming clients with 80-page financial plans, Elements provides:

12 financial vital signs that clients can easily understand and track

Score-based approach showing current state and progress over time

Mobile-first client experience allowing clients to check their financial health anytime

Collaborative planning where advisor and client work together on priorities

This tool became central to client communication because it made complex financial planning digestible for busy business owners who did not have hours to read lengthy plans.

Holistiplan: Systematic Tax Planning

Holistiplan transformed tax planning from an occasional conversation to a systematic, repeatable process:

Automated tax return analysis identifying specific opportunities and risks

Standardized tax planning reports that clients could easily understand

Multi-year projection capabilities showing the long-term impact of planning strategies

Actionable recommendations with specific dollar amounts and implementation steps

This technology enabled the firm to deliver high-quality tax planning efficiently across all clients, not just those who specifically asked for it.

Workflow Automation: Systematic Client Experience

The firm implemented workflow automation within their CRM to ensure:

Consistent service delivery with automated task creation for all client service activities

Proactive communication triggered by specific dates or client life events

Team coordination with clear task assignment and accountability

Client portal management with automated notifications and document delivery

Compliance documentation ensuring all required activities were completed and documented

These workflow automations transformed ad-hoc service delivery into a professional, predictable client experience.

The Cumulative Impact

These three strategic shifts reinforced each other:

Simplified investments freed up capacity for expanded planning services.

Expanded planning services created clear differentiation from other advisors.

Strategic technology enabled efficient delivery of the expanded services at scale.

The result was a firm that operated more efficiently, delivered substantially more value, and created a client experience that was miles ahead of competitors. They were no longer just another investment advisor—they were the go-to expert for dental practice owners seeking comprehensive financial guidance.

Action Items for Your Firm

Evaluate your service mix. What percentage of your time goes to investment management versus financial planning? Where could you create more value for your target market?

Identify your expansion opportunities. What planning services does your target market need that you currently refer out? What would it take to bring those capabilities in-house?

Assess your technology enablers. What technology would enable you to deliver elevated services efficiently? Where are you trying to deliver premium services with inadequate tools?

Communicate your philosophy. How will you explain your service model to clients and prospects? What language positions simplification as a strength rather than a limitation?

Build the capabilities. What training, education, or team development is needed to deliver on your expanded service vision?

Conclusion: Your Path Forward

The Choice Before You

You have chosen a niche market. That was the first step, and it was an important one. But now you face a choice that will determine whether your niche strategy delivers the differentiation and growth you are seeking.

Option 1: Continue operating the same way you always have, just targeting different prospects. This is the path of least resistance, but it is also the path of least differentiation. Your target market will experience you as just another financial advisor who happens to market to them.

Option 2: Commit to the transformation. Redesign your services around what your target market truly values. Rebuild your workflows to deliver a professional, differentiated client experience. Invest in technology that enables excellence at scale. This path requires more effort, but it is also the path to sustainable competitive advantage, premium fees, and client relationships built on genuine value delivery.

The firms that win are not those who simply pick a niche—they are the ones who reframe their entire approach around serving that market better than anyone else can.

Starting Your Transformation

If you are ready to transform your practice around your target market, here is how to begin:

Step 1: Conduct the Discovery Work

Use the frameworks in this guide to gain clarity on what your target market wants, needs, and expects. This is the foundation for all strategic decisions that follow.

Step 2: Audit Your Current State

Honestly assess the gaps between what your target market values and what your current service model, workflows, and technology stack deliver.

Step 3: Prioritize Your Opportunities

You cannot change everything at once. Identify the 2-3 highest-impact changes that will differentiate your firm and improve the client experience.

Step 4: Build Your Implementation Plan

Create a realistic, sequenced plan for executing your transformation.

Step 5: Get Support

Transformation is hard work. Consider whether external facilitation, coaching, or consulting support would accelerate your progress and improve outcomes.

How reframeRIA Can Help

At reframeRIA, we specialize in helping emerging RIA firms execute exactly this type of transformation. Our services include:

Discovery Workshops: Facilitated sessions that help your team gain clarity on what your target market values and where your biggest opportunities lie.

Service Model Design: Collaborative work to redesign your service offerings, pricing, and client experience around your target market.

Technology Strategy: Vendor-neutral guidance on selecting and implementing technology that enables your vision.

Process Optimization: Workflow redesign and automation to create operational excellence and scalability.

Implementation Support: Hands-on assistance to execute your transformation plan and ensure changes are successfully adopted.

Let's Talk

If this case study resonates with you and you are serious about transforming your practice around a target market, I would love to have a conversation.

We can discuss:

Where you are in your niche market journey

What obstacles are preventing you from delivering the experience you envision

How reframeRIA's approach could support your specific situation

What a potential engagement might look like

Ready to Reframe Your Future?

Interested in working together? Fill out some info and we will be in touch shortly.

We can’t wait to hear from you!